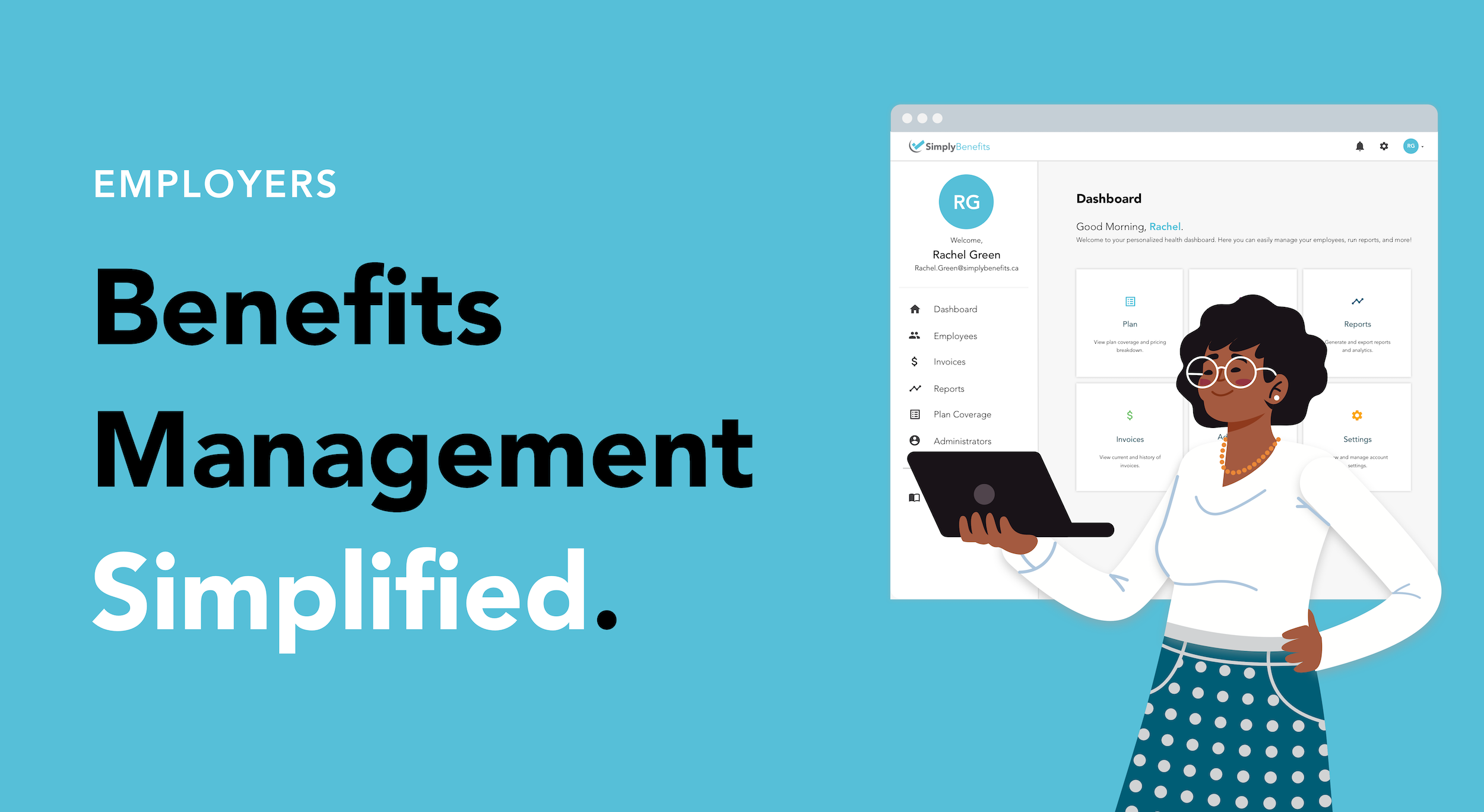

Digital Employee Health Benefits for Canadian Employers and Employees

GREAT HEALTH BENEFITS

The Best of Both Worlds.

We offer the same amazing benefit products (including fully insured, ASO and health spending accounts) to fit your coverage needs as the other guys, but on a easy-to-use digital platform. That way you can pick and choose the right benefits that everyone wants and needs.

We offer the same amazing benefits to fit your coverage needs as the other guys, but on a user-friendly platform. That way you can pick and choose the right benefits that everyone will want, and need.

Health Spending Accounts

Lifestyle Spending Accounts

Extended Health Care

Dental, Drugs

Out of Province/Country

Virtual Healthcare, Paramedicals

Major Medical, Vision

Employee Assistance Program

Dependent Life, Life Insurance

Long Term Disability

Short Term Disability

Health Spending Accounts

A Healthcare Spending Account (HSA) can be a valuable addition to a traditional benefits plan or a stand-alone plan. HSAs are tax-free, in most cases, and are usually set up with an overall maximum that allows employees to be reimbursed for medically required expenses that are not covered under their provincial health plan or their regular group benefits plan.

Lifestyle Spending Accounts

A Lifestyle Spending Account (LSA) is a taxable account that allows employers to provide employees with flexibility in how they utilize their benefits. The employer decides what categories of lifestyle and wellness products will be reimbursed, and typically allocates a maximum amount that each employee can spend.

Extended Health Care

Extended Health Care (EHC) helps cover the cost of healthcare products and services not covered by provincial healthcare plans. Employers can design a plan that reflects the degree of risk they are prepared to assume and the level of protection they want to provide their employees by choosing their coinsurance, maximums, and combination of eligible services for each type of benefit (e.g., prescription drugs, major medical, paramedical, vision care, etc.).

Paramedical Services

Paramedical coverage makes up a piece of Extended Health Care (EHC) benefits and provides coverage for a variety of practitioners not usually covered under a provincial health plan. Some of the paramedical practitioners usually included in a group plan are Massage therapy, Chiropractic services, Acupuncture, Physiotherapy, etc.

Prescription Drugs

Prescription drug coverage is one of the most important features of your benefits plan. As an employer, you need a drug plan that is sustainable and considers a population that could have an increasing need for more prescription medication. You should also consider advancements in medicine and specialty drugs, which could mean an ongoing increase in the cost of drugs and treatments.

Dental

Dental care benefits provide comprehensive dental services and supplies for plan members and their eligible dependents. The scope of most dental services covered under a dental plan usually includes three major categories: Basic, Major Restorative, and Orthodontics.

Major Medical

Major Health coverage (included under the EHC benefit) includes ambulance services, medical supplies & equipment, out-of-country medical insurance, hospital coverage, vision care, among other coverages. A wide range of options are available, and plans can be tailored to the needs of your employees.

Vision

Vision Care is usually an optional benefit included under Extended Health Care. It offers coverage for prescription eyeglasses and contact lenses.

Eye Exams

Eye exam coverage reimburses for expenses incurred when visiting a licensed optometrist or ophthalmologist.

Employee and Family Assistance Program

An Employee and Family Assistance Program (EFAP) is a professional counseling and referral service sponsored by the employer. This benefit provides service to employees, and their family members, to help resolve or cope with personal problems in a confidential and voluntary manner.

Life Insurance

Group Life insurance provides a solid foundation to an employee benefits plan. It offers essential protection when the unexpected happens — providing a financial safety net to employees and their loved ones.

Dependent Life

Dependent Life Insurance provides a flat payment in the event a covered spouse or child passes away.

Critical Illness Insurance

Critical Illness Insurance pays a flat sum to an employee and/or Spouse & Dependent if they are diagnosed with any one of several major critical illnesses included in the chosen plan (ie. heart attack, stroke, cancer, kidney failure).

Accidental Death and Dismemberment Insurance

Group AD&D pays benefits if an employee’s death is the result of an accident, or if an employee suffers the loss of use of any one of a number of limbs or body parts.

Long Term Disability

Long Term Disability offers income replacement for disease or injury that would prevent an employee from working for an extended period. Benefits are usually payable to age 65 if the disabled employee meets the Plan’s definition of disability.

Short Term Disability

Short Term Disability covers income during an employee’s short-term absence from work due to illness or injury. It pays a weekly sum based on a percentage of the employee’s gross earnings.

Out of Province / Country

Out of Country/Province or Emergency Travel Assistance coverage provides assistance and claim payment services for unexpected travel emergencies outside an employee’s province of residence.

Virtual Healthcare

Virtual care, also known as telemedicine, is the delivery of medical services over the internet or phone. We partner with Wello Virtual Healthcare to allow patients to communicate with a healthcare provider remotely, rather than in person.

DESIGNED FOR YOU

Favourite Features.

Helpful tools designed to make the benefits administration process simpler.

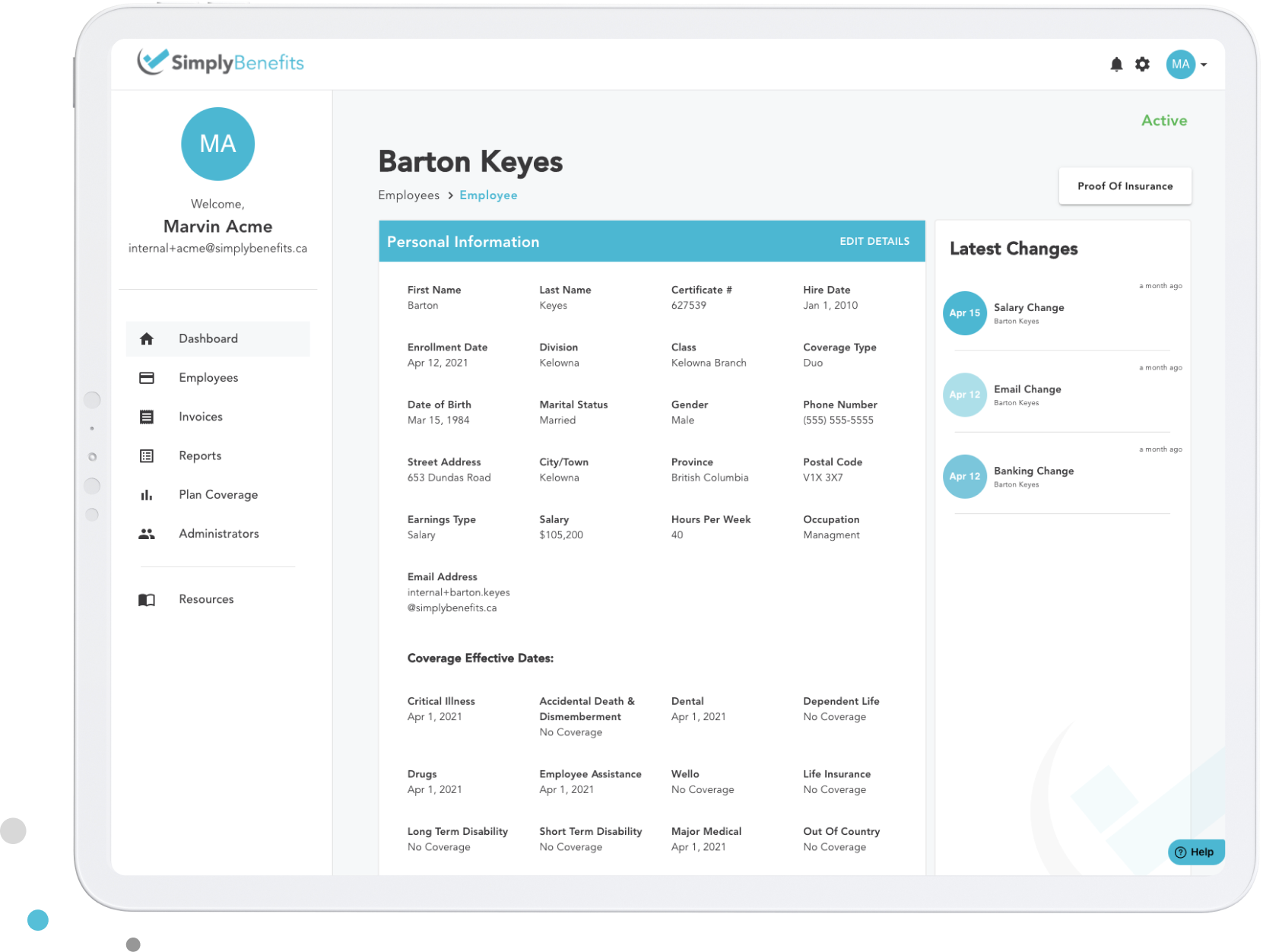

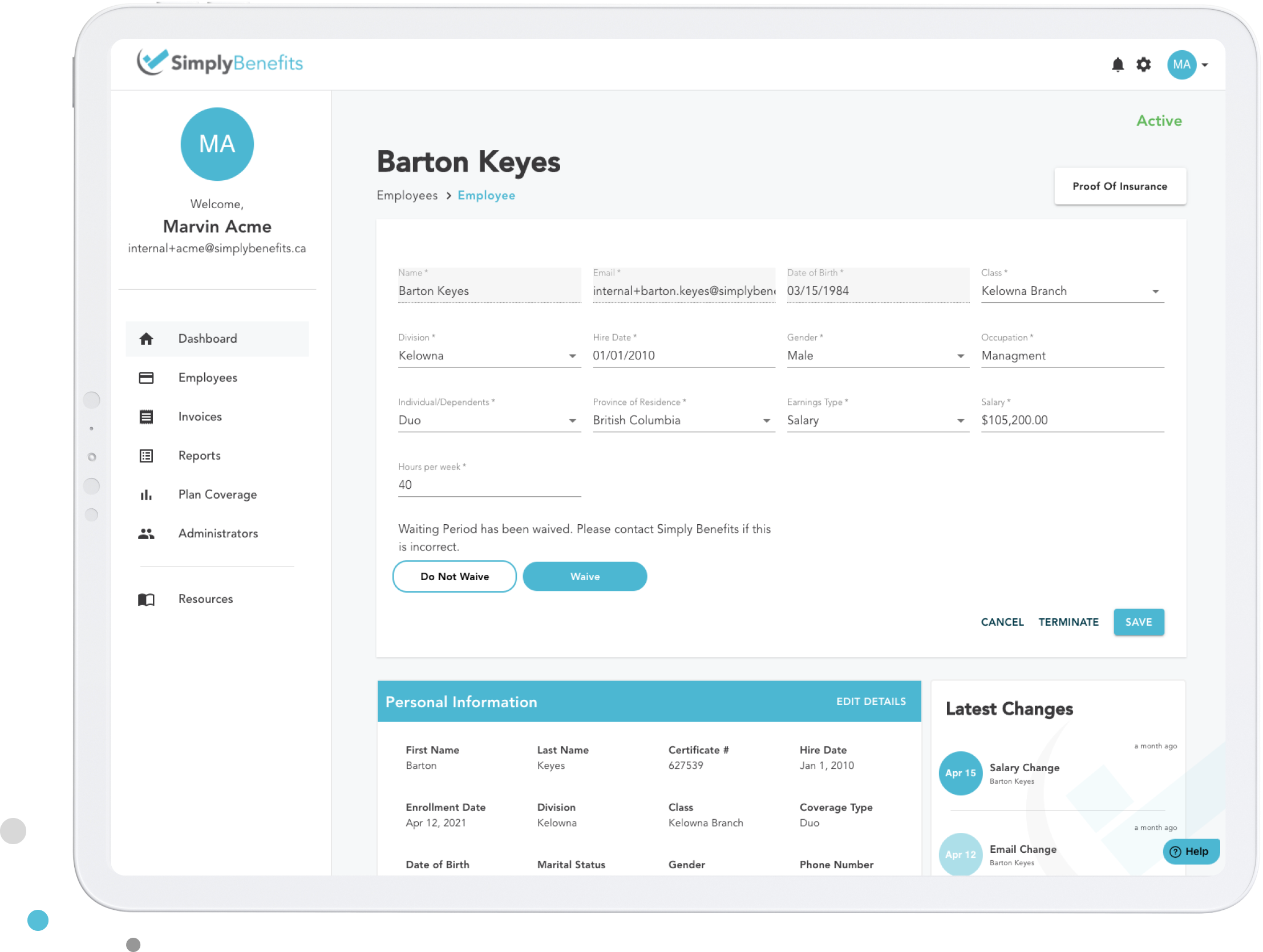

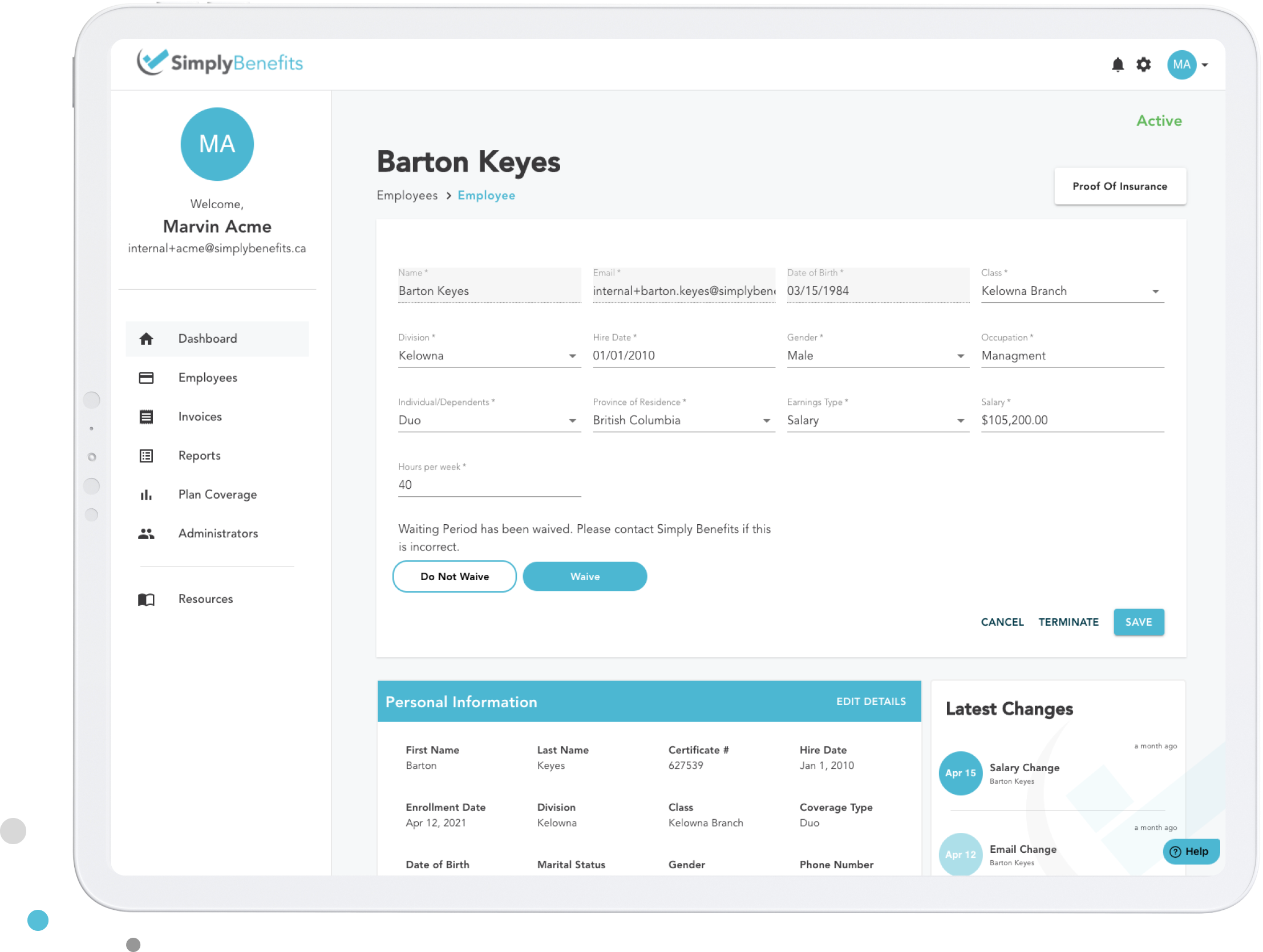

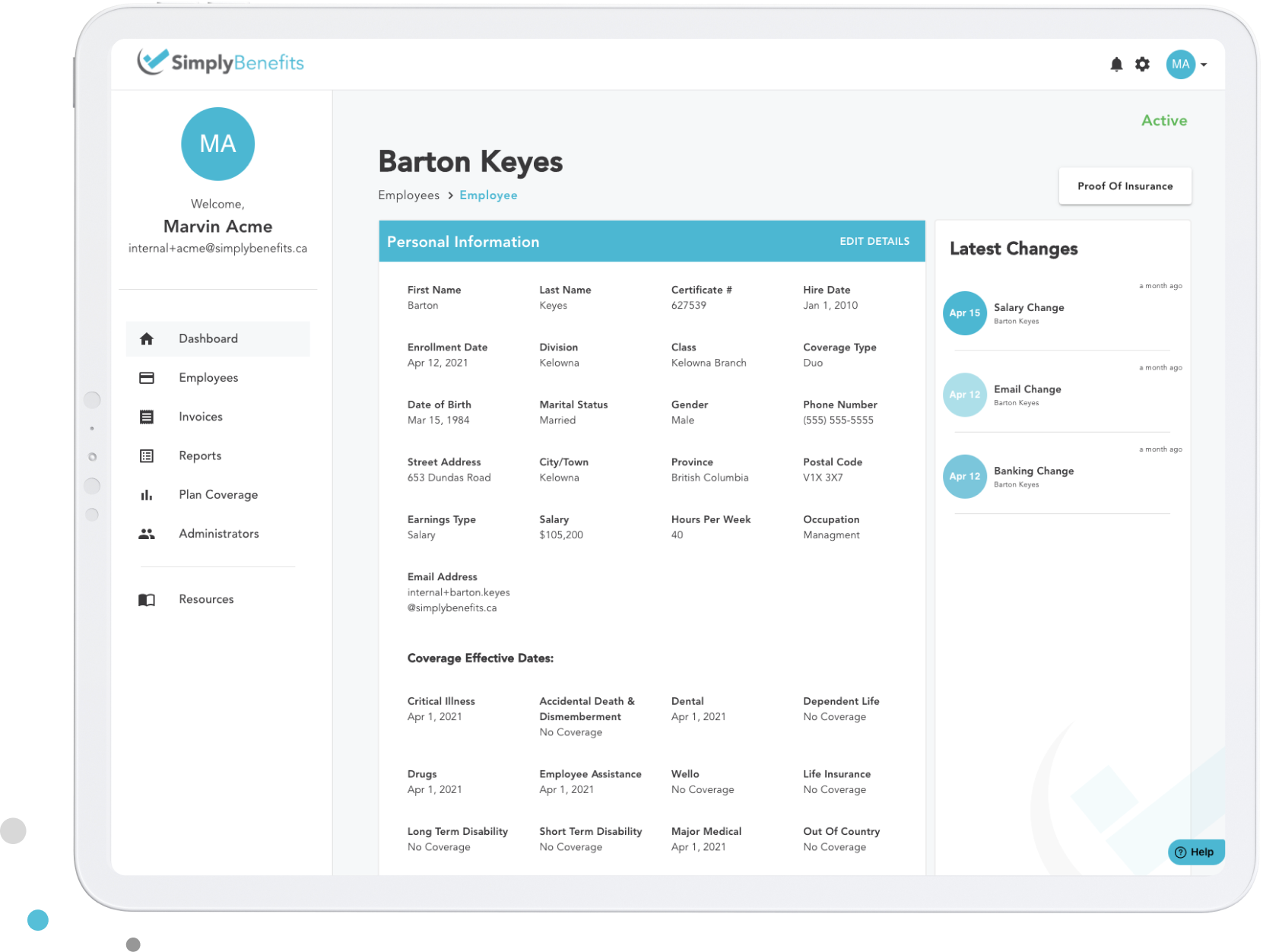

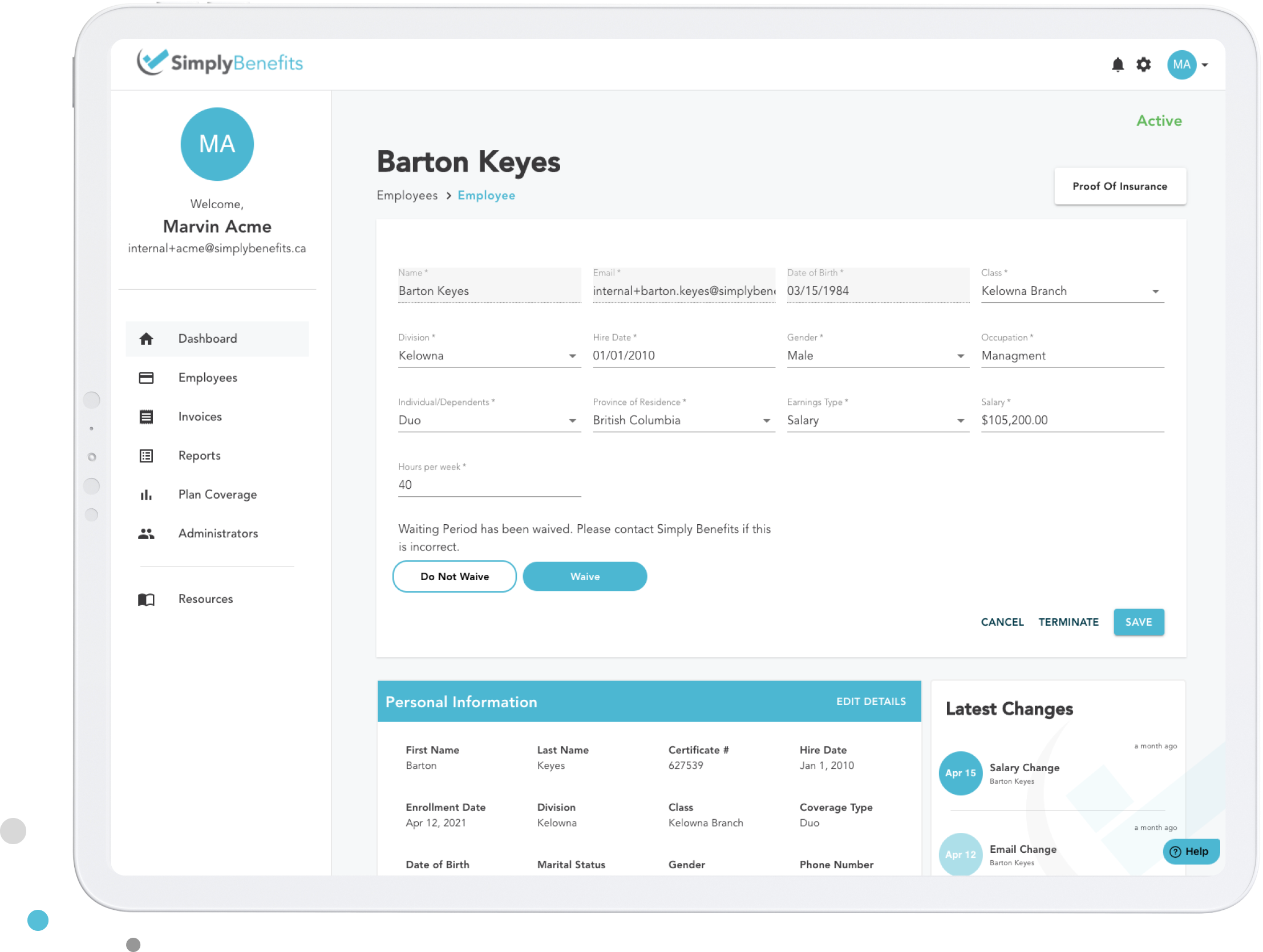

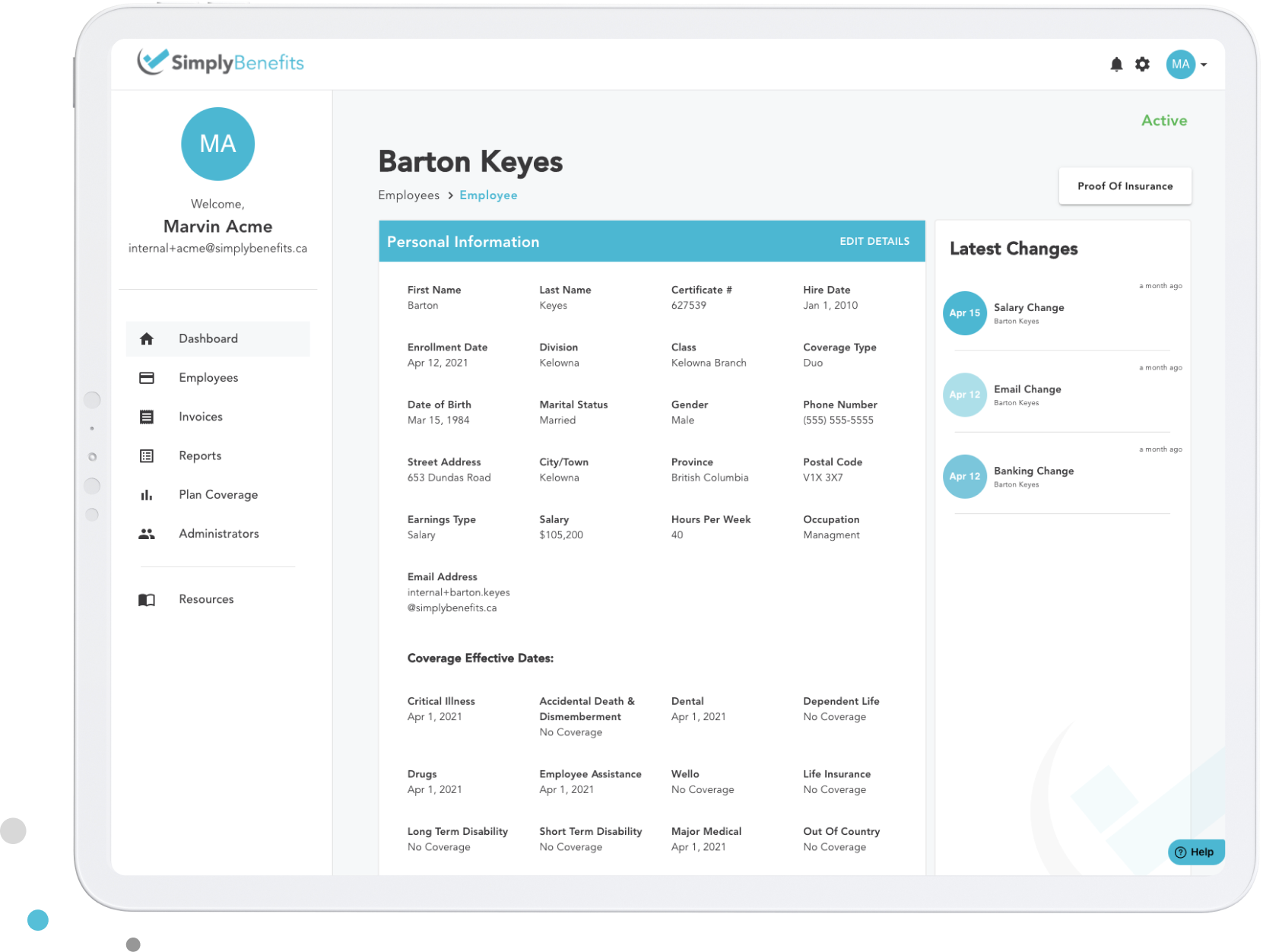

Member Health Journey.

Quickly review your members’ information, past updates, and health journey.

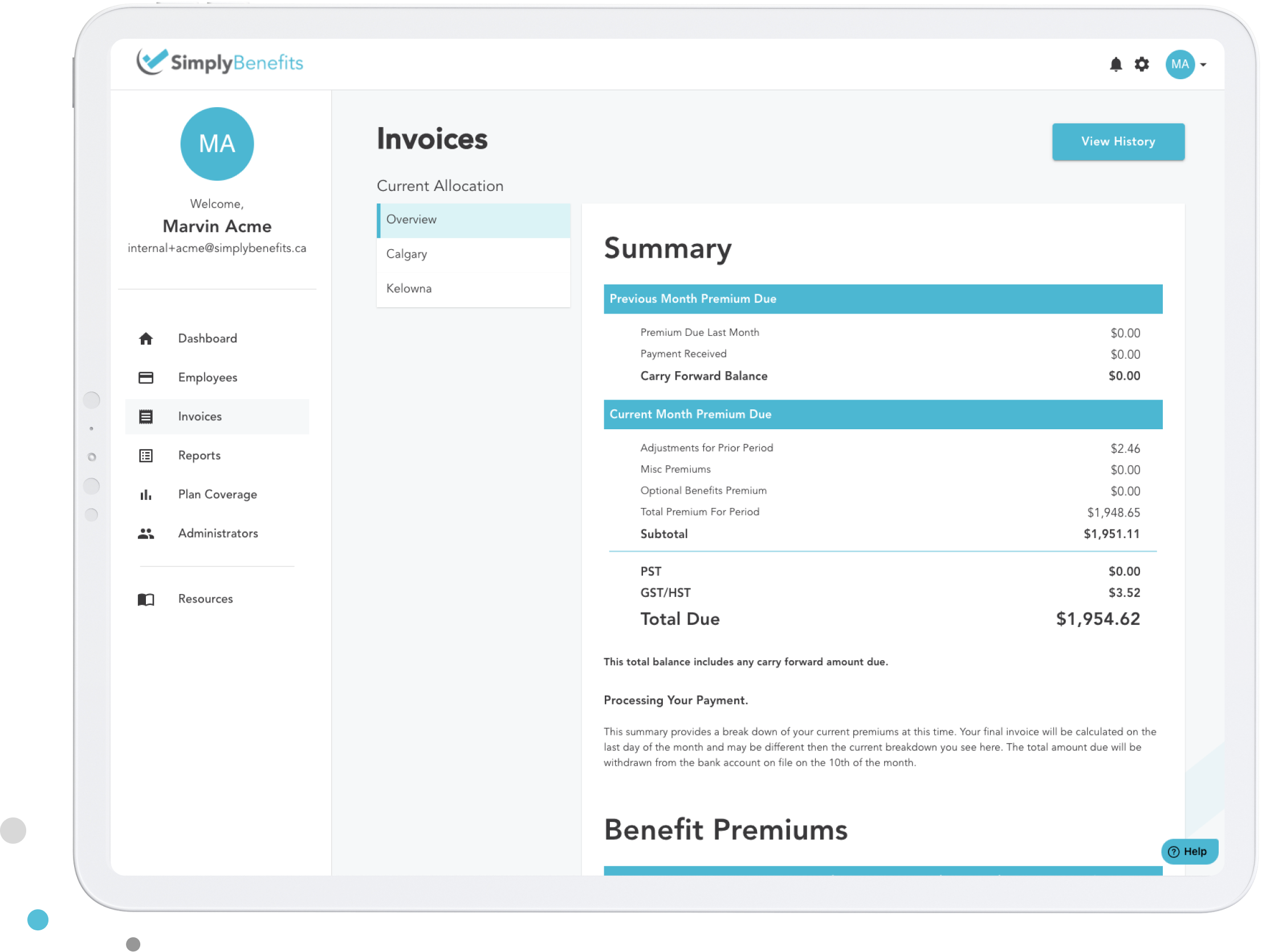

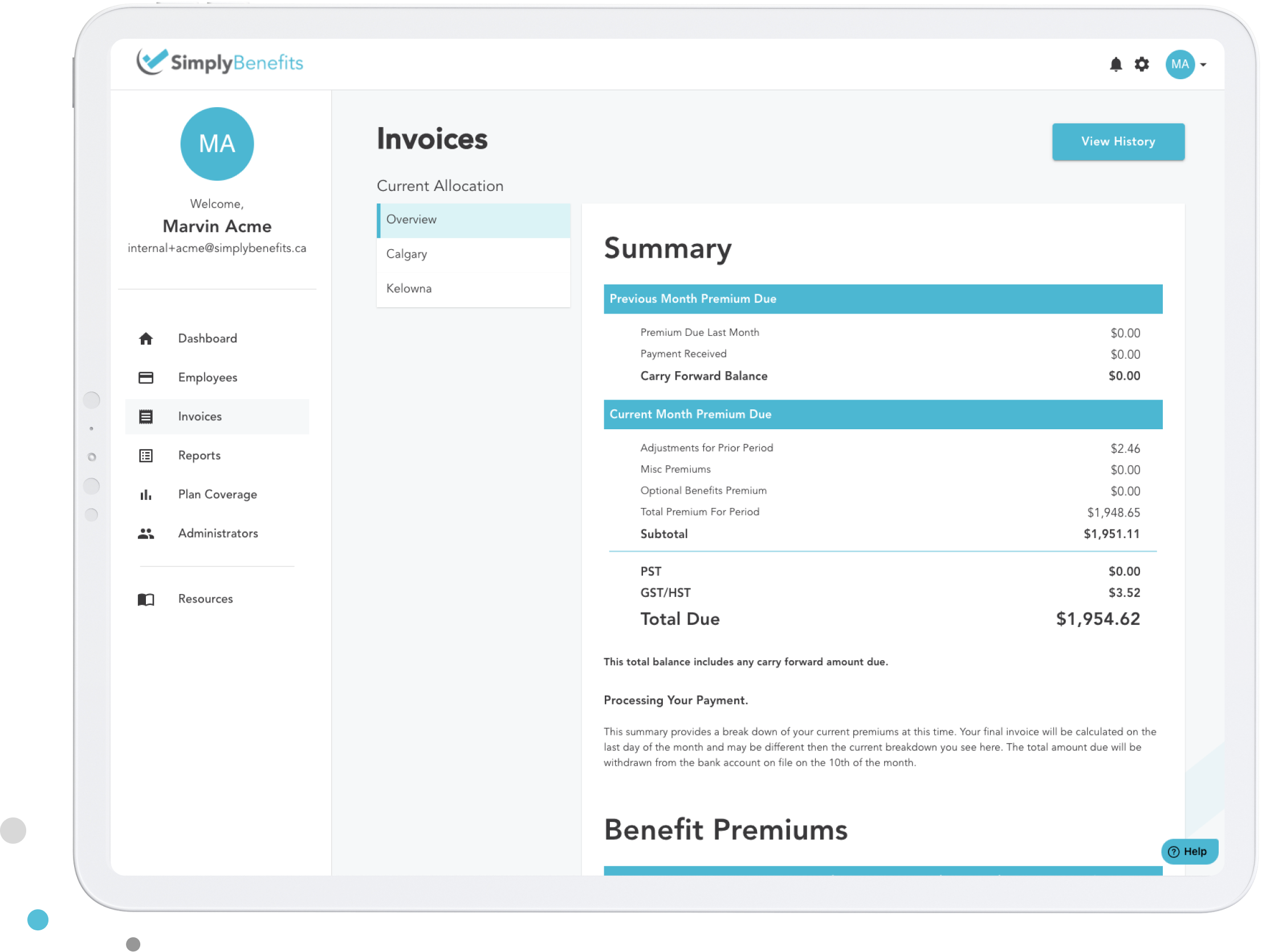

Digital Reports.

Access downloadable Member Booklets, Taxable Benefit Reports, and Billing Information all in one place.

Real-Time Updates.

Make quick changes to member information such as occupation, salary, and coverage type to ensure all data stays up-to-date.

Real-Time Updates.

Make quick changes to member information such as occupation, salary, and coverage type to ensure all data stays up-to-date.

Member Health Journey.

Quickly review your members’ information, past updates, and health journey.

Digital Reports.

Access downloadable Member Booklets, Taxable Benefit Reports, and Billing Information all in one place.

Real-Time Updates.

Make quick changes to member information such as occupation, salary, and coverage type to ensure all data stays up-to-date.

Member Health Journey.

Quickly review your members’ information, past updates, and health journey.

UNIQUE PLAN ADD-ONS

Our Partners

Provide your employees with access to benefits beyond what the traditional benefits plan includes:

Kii Employee and Family Assistance Program

Access an Employee and Family Assistance Program (EFAP) that provides compassionate, holistic support and counseling for individuals and their families experiencing work-life challenges. Services include but are not limited to:

- Financial and legal counseling services

- Nutritional health and wellness counseling

- Elder care navigation

- Child care navigation

PocketPills Digital Pharmacy

Order prescriptions digitally from the comfort of your own home with PocketPills. Our partnership with PocketPills makes medication more accessible and affordable for members. Members also get access to:

- Simply Preferred Pricing

- Free home delivery

- Live chat with a pharmacist

- Family medication management

/Maple%20Logo.png?width=175&height=59&name=Maple%20Logo.png)

Maple Online Healthcare

We partner with Wello (now Maple) to offer a virtual healthcare plan add-on. Members have 24/7 access to coast-to-coast physical and mental health professionals via mobile or desktop devices. Clinicians are able to:

- Diagnose & treat conditions

- Offer specialist referrals

- Fill/refill prescriptions

- Provide mental health support

Dialogue Virtual Healthcare

Dialogue’s Primary Care (Virtual Health) provides you with real-time access via chat, phone or video to a multidisciplinary medical team to help treat non-urgent health concerns and Dialogue’s Employee Family Assistance Program will give you access to essential wellness services to stay happy and healthy. Services include but are not limited to:

- VH: Unlimited virtual medical care 24/7, Video-based medical consultations, and Support for a wide variety of issues

- EFAP: Mental Health, Family and Relationships, Work and Career, Legal Services, and Financial Services

Gotodoctor Virtual Healthcare

Gotodoctor.ca gives you the ability to skip waiting in a walk-in clinic and see the doctor from home, work or a virtual clinic location. This convenient way to get the prescriptions, referrals, and requisitions you might need, also allows you to pick up the prescription at your preferred pharmacy or have it delivered. With gotodoctor.ca you will have:

- Access to licensed Canadian physicians via telephone or video chat

- Additional access to on-site diagnostic testing and physical assessments at in-pharmacy clinics.

- Continuity of care with the same physician team, even when traveling outside the province.

- Dedicated portal and support staff to coordinate care for you and your family members.

- Prescription and product discount at available network pharmacies.

Seedwell: Employee Financial Wellness

Seedwell is a Toronto-based fintech company specializing in financial wellness benefits that reduce the business costs of employee financial stress. Their unique combination of AI-powered personal finance automation, proprietary financial literacy, and human advisors boosts mental health and financial wealth for all employees.

- Employees are guided through actionable learning, with checklists and progress trackers to make changes in their financial life immediately

- On-demand content is created by financial experts and is designed to appeal to all types of learning styles and preferences

- The playlists are organized around different topics/life stages and contain graphic-rich videos, quizzes, articles, and calculators

- The platform also offers live webinars on a monthly basis, where employees can enjoy an interactive experience on any requested topic

BRANDING & FEATURES

Select a Portal.

We created a portal that can fit any organization's needs to help you manage your digital employee health benefits.

Pro

Our most popular, and affordable version of Simply Benefits.

checkAll features; digital drug card, claims, tracking, etc.

checkDigital management, notifications, and spending.

checkGuided setup and our world-class support team.

clearYour branding throughout the entire platform, start to finish.

clearBranded domain available and branded mobile app.

Enterprise

All the same features as Pro, but with your own branding to provide staff with a familiar branded experience.

checkAll features; digital drug card, claims, tracking, etc.

checkDigital management, notifications, and spending.

checkGuided setup and our world-class support team.

checkYour branding throughout the entire platform, start to finish.

checkBranded domain available and branded mobile app.

WORLD-CLASS SUPPORT

Expert Advice.

We have an in-house support team dedicated to providing assistance to administrators. Our team has been highly trained to offer guidance and solutions each step of the way.

NEED TO TALK TO A BENEFITS PROFESSIONAL?

We're connected with Benefits Specialists across Canada.

Purchasing employee health benefits for your unique workforce can feel daunting.

Benefits Advisors can help you navigate the complexities of benefits and design to deliver a plan that attracts and retains top talent. Good advisors give good advice.

If you aren't working with a benefits broker now or are looking to make a change, contact us and we'll introduce you to an Advisor that can help you:

• Customize a plan perfect for your team with your goals and budget in mind

• Implement a plan that is the most tax effective for you and your employees

• Negotiate with insurers to help you find the right carrier at the best price

• Educate you on plan design and funding options.

• Avoid skyrocketing premiums

• Minimize potential liabilities and navigate complex situations

QUICK ACTIONS

Your Questions, Answered.

Looking for an answer quickly? Check out our help centre for step by step solutions.

BETTER BENEFITS NOW

Ready for an upgrade?

Talk to us today about how you can get started with Simply Benefits.

TIPS & TRICKS

Benefits Blog.

Check out our latest tips & tricks about employee benefits.